Avoid Commissions, Choose Control: Why Choosing a Fee-Only Financial Advisor Benefits You

Estimated reading time: 3 min

Commission-based advisors are even worse

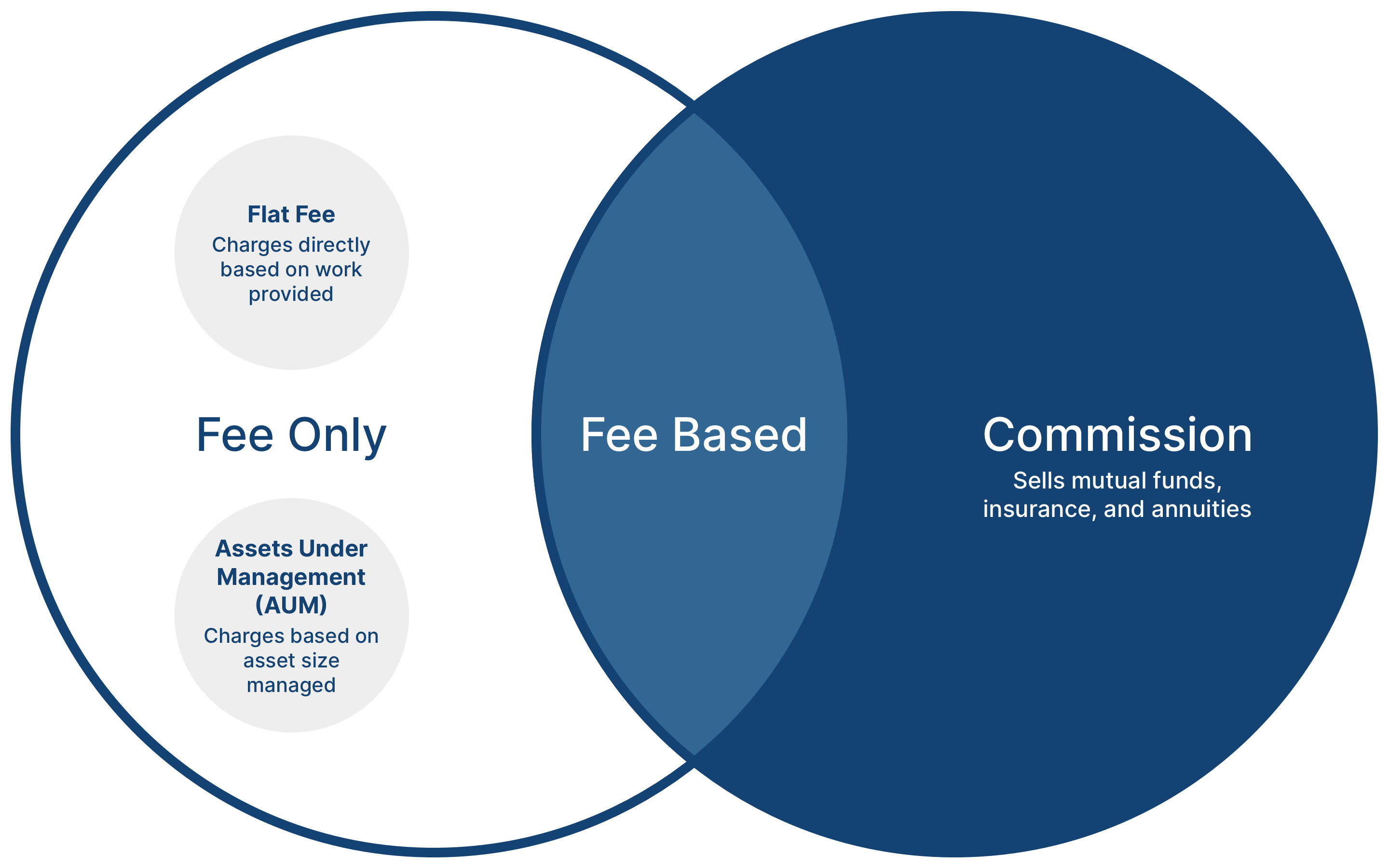

Before fee-only financial advisors became popular, most advisors were commission-based advisors. In fact, many advisors still receive commissions, but also charge fees for managing your assets. These advisors are often called fee-based advisors. While there are still a lot of fee-based advisors who receive commissions, conflicts stemming from these commissions have become well known.

The rise of fee-only advisors: putting you first

As more people realize the conflicts that commissions can cause, they demand change. This demand is being met with the rise of fee-only advisors. Fee-only advisors do not receive commissions. Instead, fee-only advisors either charge a fee based on assets managed or based on the work being done.

AUM advisor

Fee-only advisors who charge a fee based on assets are called AUM (Assets Under Management) advisors. AUM advisors often charge around 1% of the assets they manage per year. For example, an AUM advisor charging a 1% fee for managing a one million dollar portfolio charges ten thousand dollars per year.

Flat fee advisor

Advisors who charge based on the work being done are called flat fee advisors. Their fees can be hourly, monthly, quarterly, by project, or by retainer. This is very similar to the fees charged by other professions including accountants, attorneys, and doctors.

Understanding RIAs vs. Broker-Dealers

Two other terms to know when looking for a financial advisor or planner describe the types of financial firms they work under. The two types of financial firms are Registered Investment Advisor (RIA) and Broker-Dealer. Both fee-only and fee-based advisors can work under an RIA, while only commission or fee-based advisors will work under a Broker-Dealer firm.

An RIA is considered to be a fiduciary and held to a higher standard than a Broker-Dealer. A Broker-Dealer only needs to show suitability of the products they sell. Fee-based advisors can be dually registered under an RIA and a Broker-Dealer, allowing them to take their fiduciary hat on and off. It can often be hard to know when a dually registered advisor is providing fiduciary advice or selling a financial product. More information on the differences between an RIA and Broker-Dealer can be found on Investopedia’s website.

Who to trust: fee-based vs fee-only

Many commission or fee-based advisors focus on a wide variety of financial products as solutions for your needs. No wonder, their income depends on it! These products can include annuities, life insurance, long-term care insurance, long-term disability insurance, mutual funds, and alternative investments. Advisors can also receive commissions from executing brokerage trades.

Advisors who receive commissions from selling these financial products have a conflict of interest in steering you towards the products with the largest commissions. Even advisors who do not sell these products directly can have relationships with those who do and receive financial kickbacks and incentives.

Only advisors who do not receive commissions and are independent from those who do will not have this conflict of interest. These advisors can still include the above products in a financial plan and help you obtain them, but there will be no resulting conflicts of interest. This can provide you with confidence in knowing that their advice on a financial product is not based on commission size, but rather their belief that it is truly the best for your situation.

Up next

In "Don't Get Sold: Avoiding Fee-Based Financial Advisors," we will dive into financial products, what ones to avoid, the conflicts of interest commissions create, and how to identify advisors who receive commissions.

What would you like to hear about next?

Would you mind sending us an email telling us what you thought about this post or what you would like to read about in upcoming posts? I want to make sure we discuss topics you care about!

-- Josiah Peterham, Founder