The Flat Fee Advisors Journey | Finding a Flat Fee Financial Advisor

TL;DR: The Short Story

Through my journey of looking for a financial advisor, I came across flat fee, fee-only financial advisors. A flat fee is transparent and directly reflects the work being done and the experience of the advisor. From discussions and many hours of feedback given by this community, the Flat Fee Advisors matching service was developed. Flat Fee Advisors is a service matching those looking for a financial advisor with a flat fee, fee-only financial advisor well suited to serving their needs.

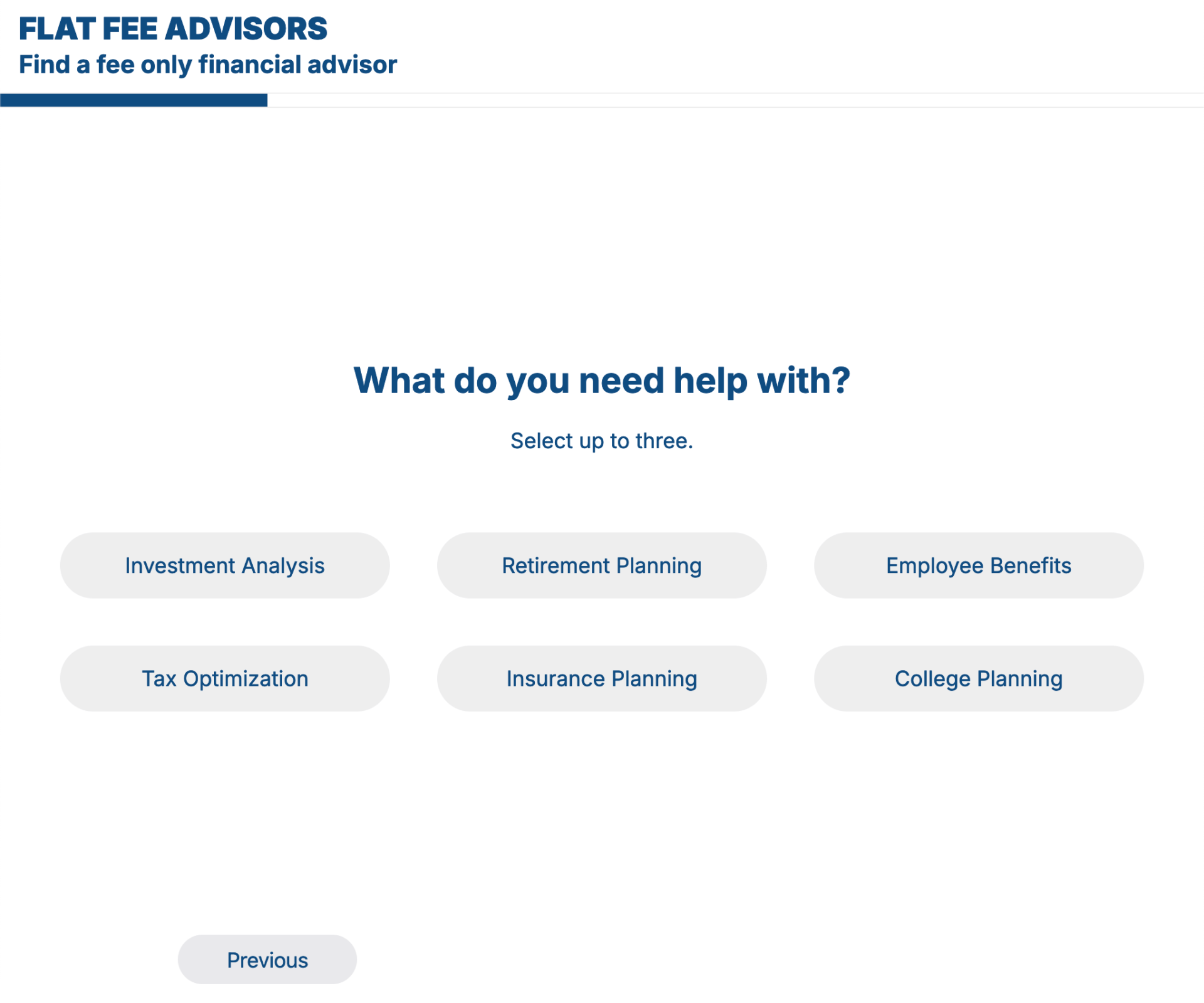

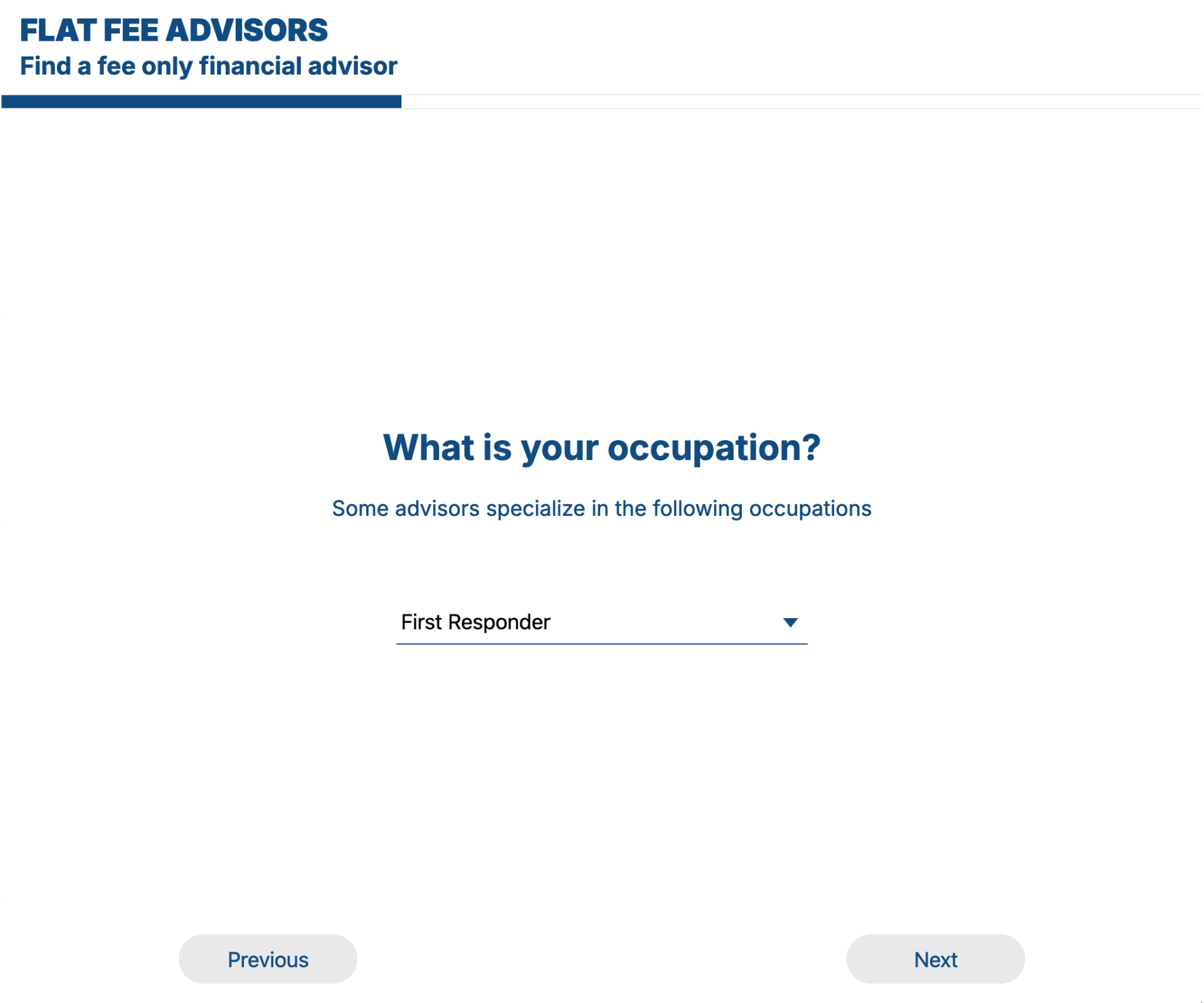

We currently match on:

- The services that are important to you

- Your occupation

- Whether you want portfolio management

- Your age

- Years until retirement

- Household income

- Total savings

Your answers enable us to match you with advisors tailored to your needs. Many advisors have expertise in specific financial areas and provide different services based on the audiences they work with. By focusing on specific niches, they can better help clients with their deeper knowledge.

For example, a business owner may prefer an advisor who provides business financial planning or CFO services. Meanwhile, someone who is about to retire may be better matched with an advisor who focuses on tax efficient withdrawal planning and medicare insurance planning. Some individuals are more DIY and looking only for a financial plan and occasional check-ins, while others do not want to think about their finances often and prefer a more fully managed service complete with portfolio management.

We're in our infancy and open to questions and feedback.

About the Founder

Hi, my name is Josiah Peterham. I started Flat Fee Advisors from my personal journey of finding a financial advisor.

I grew up in a small town outside of Rochester, NY. My father provided me with a financial education of earning money, budgeting, and investing at an early age. I've been able to build on that education with investing in the stock market throughout my life. I have two degrees from the Rochester Institute of Technology (RIT), a Bachelor of Science degree in Information Technology and Master of Science degree in Human Computer Interaction. I worked for RIT's entrepreneurial incubator and participated in many of their programs. I enjoy technology and have a love for solving problems and creating businesses out of those solutions.

The seed to how we started

What does a good financial advisor do?

During my twenties, my parents divorced and I helped my mother look for a financial advisor. This was my first experience of looking for an advisor and I quickly learned that most advisors are either focused on selling insurance and annuities or picking stocks and funds. Meeting with these financial advisors encouraged me to research online and learn more about the different types of financial advisors out there.

I met with advisors from JP Morgan, Merrill Lynch, and Vanguard, as well as a few local firms. With the exception of Vanguard, I found that advisors at every firm receive commissions. This means that they are financially motivated to recommend stocks, funds, annuities, and insurances that provide them with the largest commission. This seemed like a big and unnecessary conflict of interest.

These firms were intent on presenting charts showing how their chosen active funds outperformed the stock market. However, these charts did not include the fees charged by the funds or firms. They were also not able to provide historical evidence of outperformance over 30 or even 20 years.

When it came time for me to find my own financial advisor, I had come to understand that less than 1% of financial advisors or money managers outperform the market over 30 years. I didn’t want an advisor focused on timing the market in hopes of providing a better return. I knew better! Instead I wanted strategies on paying off my student loans, managing my retirement accounts, and buying a house.

A quick lesson

Not all advisors are paid the same way?

Inspired by my experience of finding an advisor for my mother and my own personal need for an advisor, I spoke with family and friends who had financial advisors. I also researched online for numerous hours.

Advisor Types

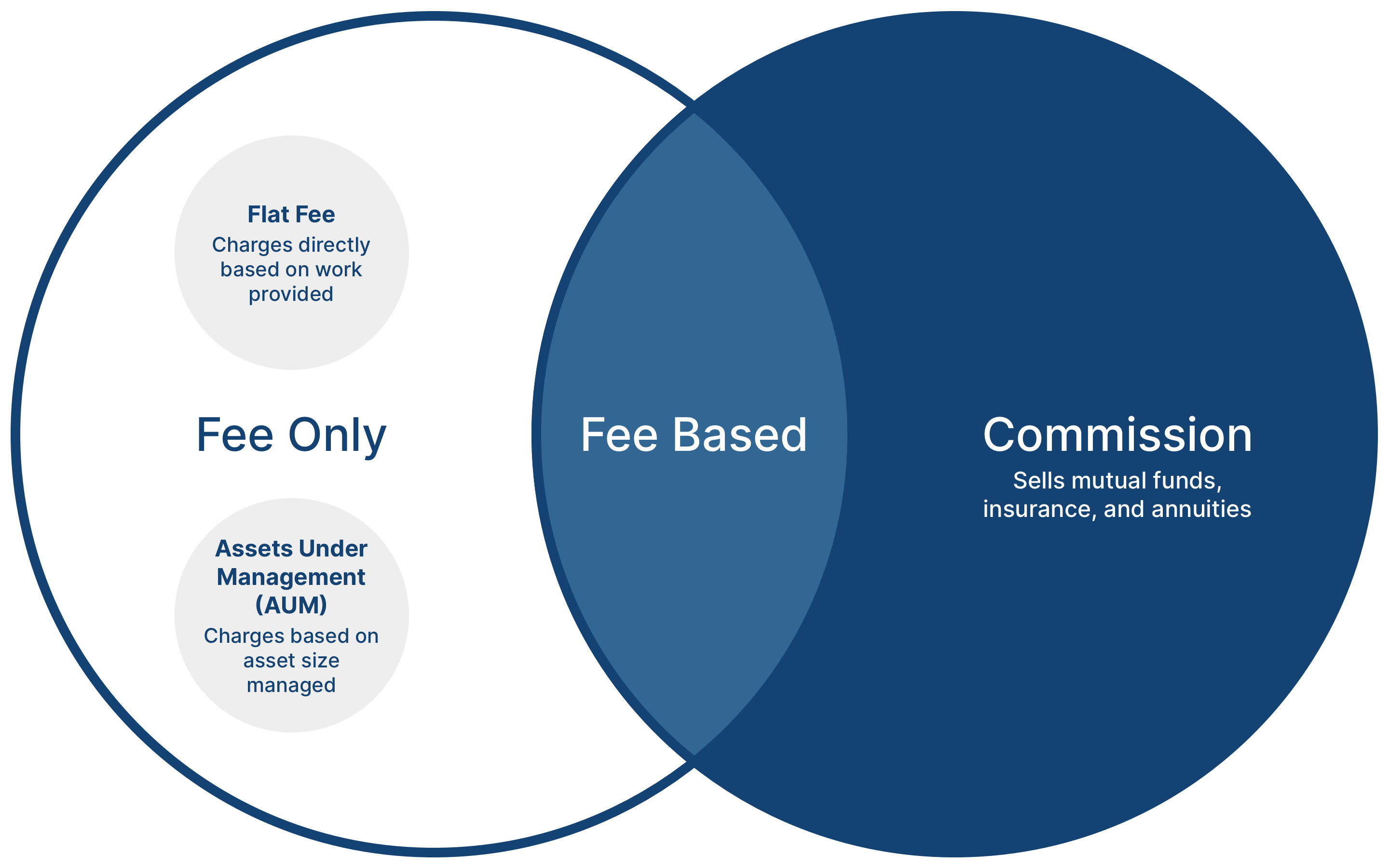

I came to learn that there are different types of advisors:

- Flat fee, fee-only advisors who charge an advisory fee solely based on the work they provide.

- Assets Under Management (AUM), fee-only advisors, who charge an advisory fee based on the size of your portfolio or net worth. This fee will increase when you earn, save, and invest more.

- Commission based advisors, who earn commissions from the financial products they recommend.

- Fee based advisors, who receive both a commission, along with charging an advisory fee.

While many of the financial advisors out there are focused on helping their clients and provide a beneficial service, flat fee advisors have the least conflicts of interest and provide the most transparency. They focus on a comprehensive service, rather than simply managing your portfolio or selling you financial products. Furthermore, they put their money where their mouth is by earning an income solely from the fee that reflects their comprehensive service.

Flat Fee, Fee-Only (least conflicted)

- Motivated to take more time completing work so that they can charge more.

AUM (in the middle)

- Just because you work hard to make more and save more, doesn't mean their work increases and that they should be paid more.

- Incentivized to do the least amount of work to maintain current clients in order to focus on attracting more clients because it's easier for them to make more money collecting new client assets than it is to increase portfolio returns.

- Motivated to prematurely rollover 401(k) or 403(b) to increase their management fee.

- May not recommend paying off high interest mortgages or debts because that would reduce their fee.

- May dissuade you from real estate or other investments that would reduce their management fee.

Commission (most conflicted)

- Motivated to sell financial products that provide them the highest commission and are not necessarily in your best interest.

- Motivated to sell insurance policies including whole life insurance, universal insurance, disability insurance, and long term care insurance.

- Motivated to sell annuities that often have high fees and provide comparably lower returns.

- Motivated to sell mutual funds or trade stocks with high fees and commissions.

- Incentivized to move funds out of retirement accounts to purchase financial products.

An idea took root

Where are the flat fee financial advisors?

At this point, I decided I wanted to work with a flat fee advisor, but how could I find one? There's a half dozen advisor networks out there that have made great progress in helping people connect with financial advisors. Many of them weed out advisors who make commissions and focus on fee-only advisors. Another resource, Bill Baldwin, a senior contributor and editor at Forbes has a growing list of flat fee advisors who charge by the hour.

However, it was still tough finding advisors in the flat fee community that matched with my specific needs. I looked to the SEC database and tediously searched for them. After compiling my own list, I began reaching out to them. From discussions with advisors in this flat fee community, a trend emerged. Many acknowledge there is a growing demand leading to more advisors switching their firms to a flat fee model. However, there is still a lack of public awareness regarding flat fee advisors. Furthermore, the people who know of flat fee advisors express their difficulties in finding one, much less finding one that fits their unique needs.

From continued discussions, an idea for a platform designed to help people find advisors exclusively in the flat fee community took root. Instead of following the approach of creating a directory of advisors, we took inspiration from popular matching services. Some of these services include state and county bar associations to find attorneys, services like ZocDoc to find local doctors, and of course, dating apps. Once the idea for a matching service to help people find flat fee advisors who fit their needs emerged, I developed a prototype.

Our growth

Who is building Flat Fee Advisors?

Thanks to the tremendous amount of time and energy given by the community of flat fee, fee-only advisors, the prototype evolved to the point where it could be developed to be functional. I'm lucky enough to have a close friend and alum from my alma mater, RIT, who is a talented brand and interface designer at Ryan Dixon Studio. He has helped throughout the journey of Flat Fee Advisors and continues to provide support. I'm also lucky to have the help of another alum, who I have enjoyed working with on multiple projects since our time at the university. He's a dedicated web developer at Soft Clay Software, whose passion always shines through. He leads development and continues to evolve the service based on feedback from advisors and users. Once the service had been developed to be fully functioning, another alum came to my aid. Linden Digital Marketing is leading our marketing strategies and manages our ads, spreading the word about flat fee, fee-only advisors.

Ryan Dixon @ Ryan Dixon Studio

Josh Vickerson @ Soft Clay Software

Team @ Linden Digital Marketing

Where is Flat Fee Advisors now and what's next?

The experiences of growing up with an early financial education coupled with helping my mother find a financial advisor and working with my own financial advisor have confirmed the need for the flat fee advising community. While Flat Fee Advisors is still in its infancy, further feedback will continue to help us evolve it into a beneficial service matching those in need with flat fee, fee-only financial advisors well suited to serve those needs.

We currently have 92 firms on board with offices spanning the country in 29 states, including Arizona, California, Colorado, Connecticut, Florida, Georgia, Iowa, Idaho, Illinois, Massachusetts, Maryland, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, Nebraska, New Jersey, New York, Ohio, Oregon, Pennsylvania, South Carolina, Texas, Utah, Virginia, Washington, and Wisconsin.

Map here

More about the service

How do we evaluate advisors?

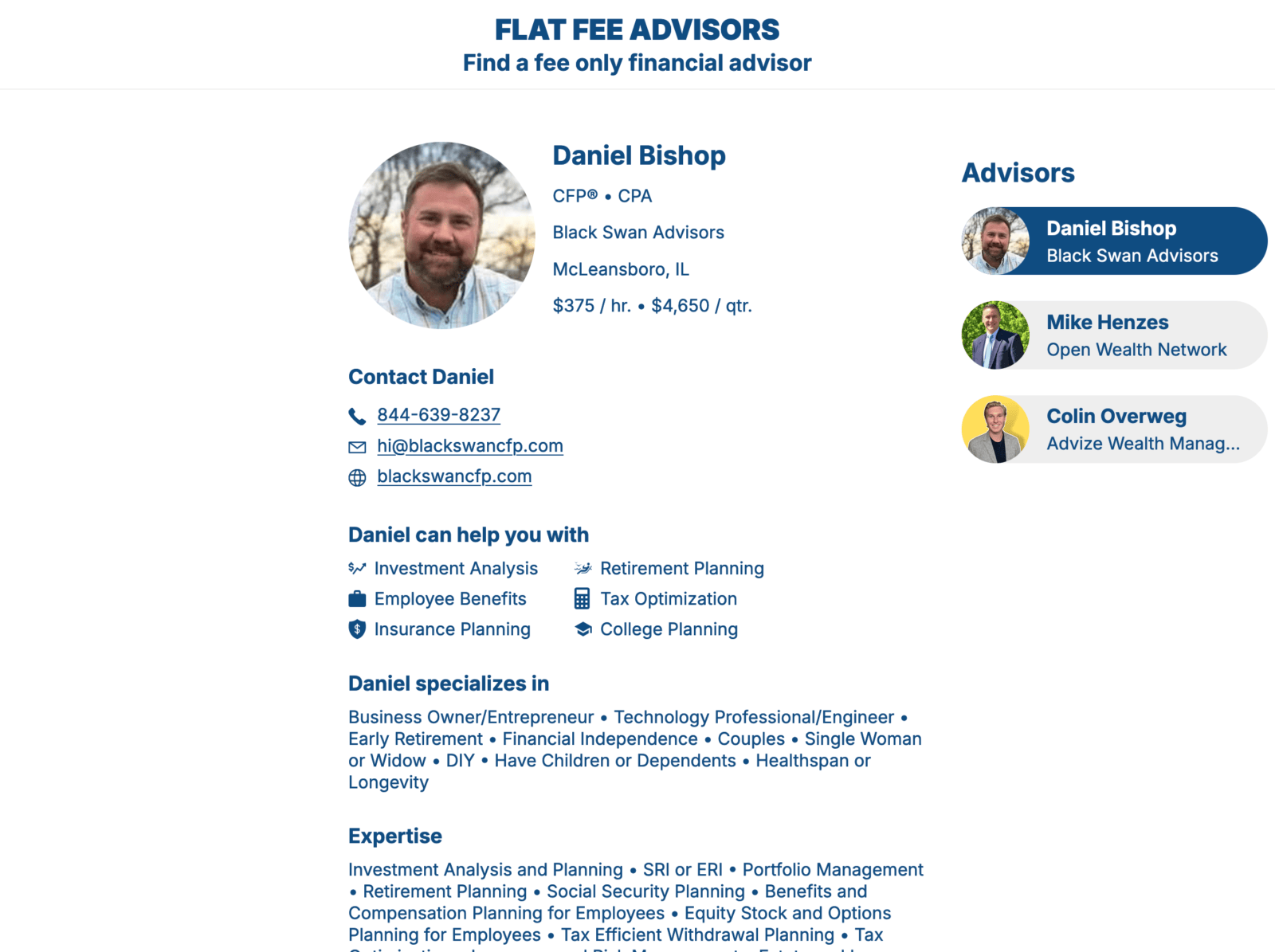

Each advisor has been thoroughly vetted. Their websites are reviewed and each advisor is personally communicated with to verify further details. All of the advisors on board provide their services exclusively at a flat rate. This means they charge either hourly, or by a monthly, quarterly, or annual subscription, or by project.

The SEC requires all professional investment advisers to submit SEC or state form ADVs. These forms serve as a registration document that identifies fee structures, investment styles, assets under management, key officers, and other important information. We review each advisor’s form ADV and confirm that it passes 32 different verifications. Some of these verifications include whether the advisor is fee-only, fiduciary, properly educated and experienced, exclusively offers a flat fee, and follows 2013 Nobel Prize winning philosophies. We also verify that each individual advisor has no conflicting relationships with banks, venture funds, private funds, broker dealers and representatives, insurance brokers and representatives, insurance agents and representatives, commodity pool operators, futures commission merchants, registered municipal advisors, security-based swap participants, etc.

Our advisors can do what?

Each advisor focuses on specific financial planning services. We track and display the following services in each advisor’s profile. We also include their average fees, location, certifications, specializations, and short bios.

Individual Financial Planning Services

Investment Analysis and Planning, SRI or ERI, Portfolio Management, Portfolio Guidance, Retirement Planning, Social Security Planning, Benefits and Compensation Planning for Employees, Equity Stock and Options Planning for Employees, Tax Efficient Withdrawal Planning, Tax Optimization, Tax Preparation, Insurance and Risk Management, Self Employed Health Insurance Planning, Medicare Insurance Planning, Estate and Legacy Planning, Charitable Giving, Cash Flow Analysis, Budgeting, Debt Management, Student Loan Repayment, Saving and Investing for College, College Search Scholarship and Funding Planning, Late Stage College Funding and Planning, Financial Behavior and Wellness Education, Life Event Planning, Travel Planning, Divorce Planning, Military and Veteran Benefits Planning, Special Needs Planning, Windfall Planning, Intergenerational Planning, Real Estate Planning, Digital Assets and Currencies, Family Office Services, Domestic Relocation Planning, International or Cross Border or Expat Planning

Business Financial Planning Services

Business Finance Planning, Benefits and Compensation Planning for Employers, Equity Stock Options Planning for Employers, CFO Services, Exit Planning, Value Acceleration, Strategy Consultants