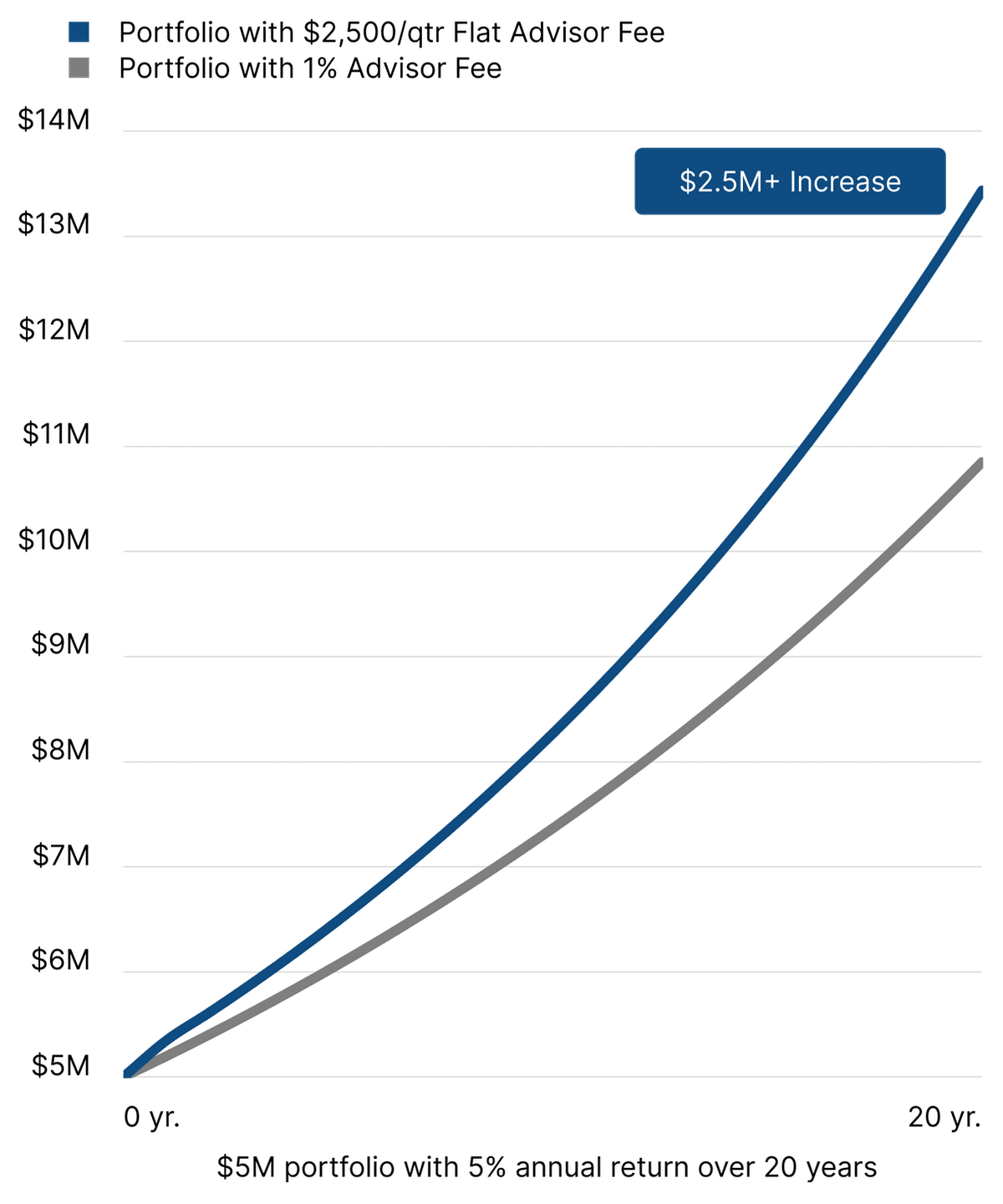

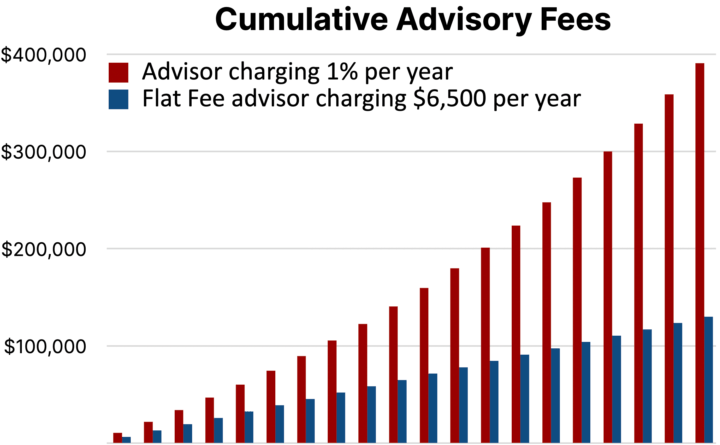

A flat fee is transparent and directly reflects the work being done and the experience of the advisor. It also doesn't increase when you contribute to your retirement plan or your portfolio grows in value.

Have more questions?

See our FAQ

Stephen Nelson

Carlsbad, CA

Matt Cooley

Boise, ID

Christopher Sherman

Chapel Hill, NC

A flat fee is transparent and directly reflects the work being done and the experience of the advisor. It also doesn't increase when you contribute to your retirement plan or your portfolio grows in value.

Have more questions?

See our FAQ

Are you looking for complete transparency and control when it comes to your finances? Are you getting close to retirement? Did you receive an inheritance larger than what you’re comfortable with? Are you starting a business and ready to invest your money? Or are you looking for help gaining financial control? You are in the right spot. Take this short quiz to be matched with a fee-only financial advisor.

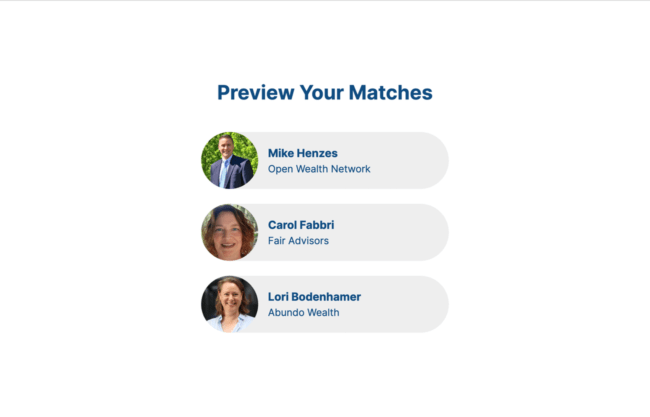

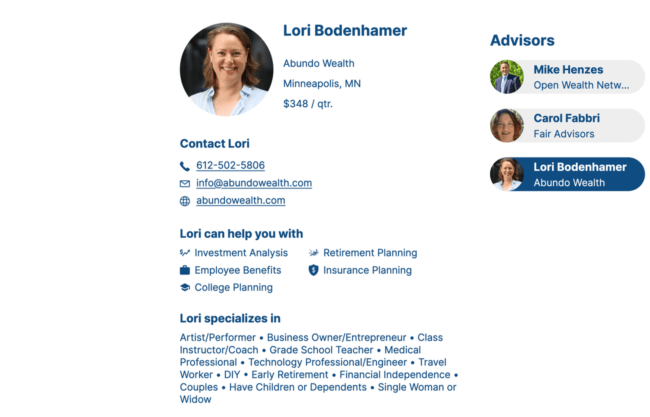

We use a one-of-a-kind algorithm to match you with three flat fee financial advisors who are best suited to your unique financial situation. This is important because everyone has different needs and many advisors specialize in different niches, from student loans, to occupation specific employee benefits, to tax optimization, to business owners, to retirement planning, etc.

Empowering you to choose who you connect with.

All of our flat fee, fee-only financial advisors are leading the industry into the future by offering comprehensive financial planning with easy, transparent pricing.

One agreed upon flat fee

Only compensated by you

Required to work in your best interest

Focused on the whole picture

Embracing Nobel Prize winning philosophies

Incorporating time tested strategies