Flat Fee Financial Advice from a Flat Fee Financial Advisor

Estimated reading time: 6 min

What is a flat fee financial advisor?

A flat fee financial advisor is a fee-only financial advisor who provides financial advice for a fixed fee. This means they do not charge based on a percentage of your assets, or receive commissions from financial products they may advise you on.

The benefits of a flat fee are transparent pricing, conflict-free advice, and a focus on comprehensive financial planning. Fees should be based on the work being done and the experience of the advisor and their firm. These fees shouldn’t increase simply because the market goes up or you contribute more money to your 401(k).

A flat fee is very similar to how accountants, attorneys, and many other professions charge. It makes sense! A more in depth summary of flat fee financial advisors can be found in our blog post "What is a Flat Fee Financial Advisor?"

How do most other financial advisors make money?

Asset-based financial advisor (AUM financial advisor)

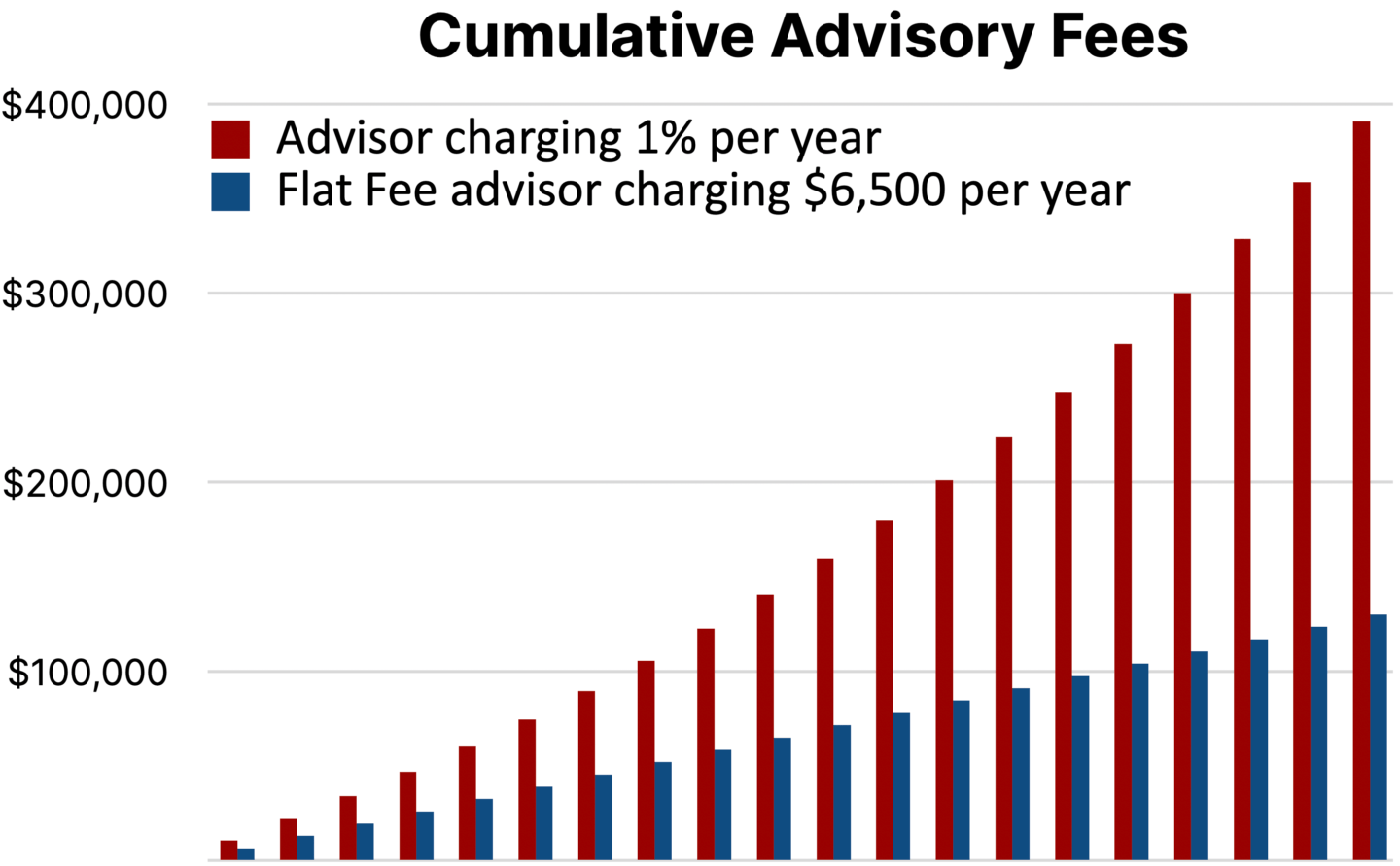

Asset-based financial advisors often charge one percent of your portfolio every year. While one percent may not seem like a lot, it can easily turn into hundreds of thousands of dollars over a few decades. This quickly eats into your portfolio. Take a look at this graph we put on our landing page and make the calculations yourself. A difference this large could mean retiring years earlier.

Asset-based fees put focus on investment management and portfolio performance

While this may sound like a good thing, investment management is only part of the value an advisor should offer when providing comprehensive financial planning. In fact, only so much can be done to optimize a portfolio's return while maintaining intended volatility. Facets of comprehensive financial planning like tax planning or estate planning can significantly impact your financial return as well. If the majority of the financial advisor’s focus is on managing investments, the rest of your financial plan will be lacking.

Conflicts of interest

There will always be conflicts of interest, with some more easily evaluated than others. While a one percent fee may seem simple to evaluate, ways asset-based financial advisors may try to increase this fee may not be as transparent. One way of increasing this fee includes rolling over your 401(k) or other retirement plans for them to increase asset size and thus fee size. Another is by investing a higher portion of your savings in equities than you should be invested in.

You may even be in a financial position to retire, but an advisor who doesn’t want their fee to decrease may push you to work a few more years. Advisors may also suggest taking social security payments earlier than could be wise or dissuade you from paying off a mortgage or auto loan. Anything to maintain or increase the amount of your assets they manage. They may even dissuade you from starting a business if it means investing some of your assets into it. Other examples of conflicts of interest can be found in our previous blog, ”Ditch the AUM: Find Flat Fee Financial Advisors Near You”.

Commission-based financial advisors

Commission-based financial advisors, also known as fee-based financial advisors, receive commissions and kickbacks when they sell you financial products like life insurance and annuities. These commissions and hidden fees can be hard to identify and again, can quickly eat into your portfolio. According to NerdWallet, typically “5% to 10% of all the premiums you pay over the life of the policy could go to commissions.”

Commission-based fees put focus on financial products

While you may need some term life insurance or long-term care insurance, they should only be part of a comprehensive financial plan. However, when an advisor’s income is married to the commissions they receive, they’re motivated to spend as much time as possible marketing products with the highest commissions, while spending as little time as possible on all the other parts of financial planning. This leaves you with a weak financial foundation for your future.

Conflicts of interest

Again, while you may need one or two financial products, there’s a conflict of interest when an advisor sells you these products. That’s because they’re incentivized to sell you the product that makes them the largest commission, even if it’s not in your best interest. Other conflicts of interest can be found in our previous blog, "Don't Get Sold: Avoiding Fee-Based Financial Advisors". A better way to purchase these products is to work with an advisor who doesn’t receive a commission from selling them. One option is to work with someone who utilizes a service like DPL Financial Partners.

Unlike fee-only financial advisors who are typically fiduciary, commission-based financial advisors are not required to be fiduciary. This means they don’t have to provide advice that’s in your best interest. A graph comparing the different financial advisors can be found in our previous blog, "Avoid Commissions, Choose Control: Why Choosing a Fee-Only Financial Advisor Benefits You".

Benefits of a flat fee financial advisor

While many advisors market themselves as fiduciary, it can be difficult to prove any breach of their fiduciary duty in court. It’s always best to be proactive and fully understand the reasons behind a proposed financial plan. If the financial advisor is not able to provide a financial plan in simple terms, they may be using complexity to hide large fees and commissions. Especially now that the DOL Fiduciary Rule is no longer upheld, it may be best to protect yourself by knowing exactly how the financial advisor makes money and the exact dollar amount of those fees.

Transparency

This is where a flat fee financial advisor comes in. The way a flat fee financial advisor makes their money is transparent and directly reflects the work being done, as well as the experience of the advisor. Flat fee financial advice makes it easier to identify if the fee you’re being charged makes sense for the work being completed.

Conflict-free advice

While no transaction can ever be conflict-free, a flat fee structure is as good as it gets. The only conflicts stemming from this fee structure are when an advisor may take longer to get the work done or charge more than the work is worth. This conflict is a lot easier to evaluate. No wonder most other professions charge this way. It’s demanded by the consumer!

Comprehensive financial planning

While other financial advisors may focus on managing investments or selling financial products because that’s what their fees or commissions are tied to, flat fee financial advisors put their focus on comprehensive financial planning. That’s because their fee is directly tied to it! When a flat fee is tied to the whole financial plan, there’s no reason for an advisor to focus on one part while omitting another. By having a complete comprehensive financial plan, your financial future will have a strong foundation to build on.

Aspects of comprehensive financial planning and the services a flat fee financial advisor provides

A flat fee can inherently put focus on a comprehensive financial plan and provide many of the following services. You may need all or only a few of these services and may be able to negotiate a flat fee tailored for your needs.

- Cash flow management: Implementing and following a budget to meet financial goals while covering expenses.

- Investment analysis: Creating an asset allocation based on your needs. Usually, to increase performance while reducing unnecessary portfolio volatility. Determining allocations between retirement, brokerage accounts, etc. is a part of this.

- Investment management: Rebalancing your portfolio when necessary to maintain a specified asset allocation. Making contributions or distributions according to the plan set during investment analysis.

- Tax planning: Not to be confused with filing taxes, this service helps to legally minimize your tax obligations. An example would be mandatory withdrawal planning for a retirement plan like a 401(k) or IRA.

- Life event planning: Preparing for goals like buying a house, having a child, retiring, or buying a second home.

- Insurance planning: Determining the amount of insurance you may need to provide adequate coverage. This can include health insurance, life insurance, long-term care insurance, property insurance, etc.

- Retirement planning: Calculating the amount of money you want to retire with and when you will have that amount, while considering medical care and other expenses.

- Estate planning: Involves creating legal documents like wills or trusts, designating beneficiaries, and minimizing taxes and legal complications to ensure a smooth transfer of your assets.

- Other services of a flat fee financial advisor can be found on our journey page.

How to find flat fee financial advisors near you

Finding the right flat fee financial advisor can be easy! Use our quiz to find flat fee financial advisors near you. All of these financial advisors are fee-only financial advisors who provide flat fee financial advice and who only charge for the services they provide. They do not earn commissions on products they sell. They all act as flat fee fiduciaries, meaning they are legally obligated to act in your best interest. Look over their websites, as well as their ADVs, which can be found at adviserinfo.sec.gov. Once you’ve found a few that you like, schedule free consultations with them to decide who is best for you.

Up next

Our next post, "Advice-Only Financial Advisor: The Abundo Wealth Difference," is going to be our first ever guest article, featuring Eric Simonson, who is the founder and CEO of Abundo Wealth. The post will share his inspiration of helping those who don’t have access to work with a traditional advisor and the journey of Abundo Wealth.

Eric has been one of the flat fee financial advisors who has supported us early on. He’s a believer in flat fee financial advisors, specifically advice only financial advisors. He’s also a believer in transparent pricing and using proven low-cost investments.

Abundo Wealth is one of the fastest growing flat fee financial planning firms in the country. They have been quoted in articles from the Washington Post, New York Times, Yahoo Finance, and CNBC.

What would you like to hear about next?

Would you mind sending us an email telling us what you thought about this post or what you would like to read about in upcoming posts? I want to make sure we discuss topics you care about!

-- Josiah Peterham, Founder